A holistic approach to risk management to unlock value

VAT Reform

PwC Brasil’s approach to the VAT Reform

PwC Brasil positions itself as a strategic partner for corporations navigating the complexities and opportunities of Brazil’s VAT Reform. Guided by a holistic risk management framework, we leverage cutting-edge technologies and predictive analytics to enable businesses to understand the real impacts of the reform. Our insights allow them to refine their strategies both efficiently and securely.

Our integrated approach covers various business areas, from operational restructuring to adapting processes and systems. We offer ongoing support so our clients can confidently navigate the new Brazilian tax scenario, using the reform as a powerful lever to generate value and competitive advantage.

With our expertise, we structure a journey based on five pillars and four primary channels of transformation — data, technology, processes, and people. This strategic framework prepares companies to proactively and effectively undergo significant changes in their business models and financial operations in the coming years. By doing so, they can adeptly navigate the challenges posed by the VAT Reform, ensuring sustainable and lasting outcomes.

Transformation journey

In the next few years, multiple business sectors will undergo significant changes influenced by disruptive technologies, each requiring case-specific evaluations:

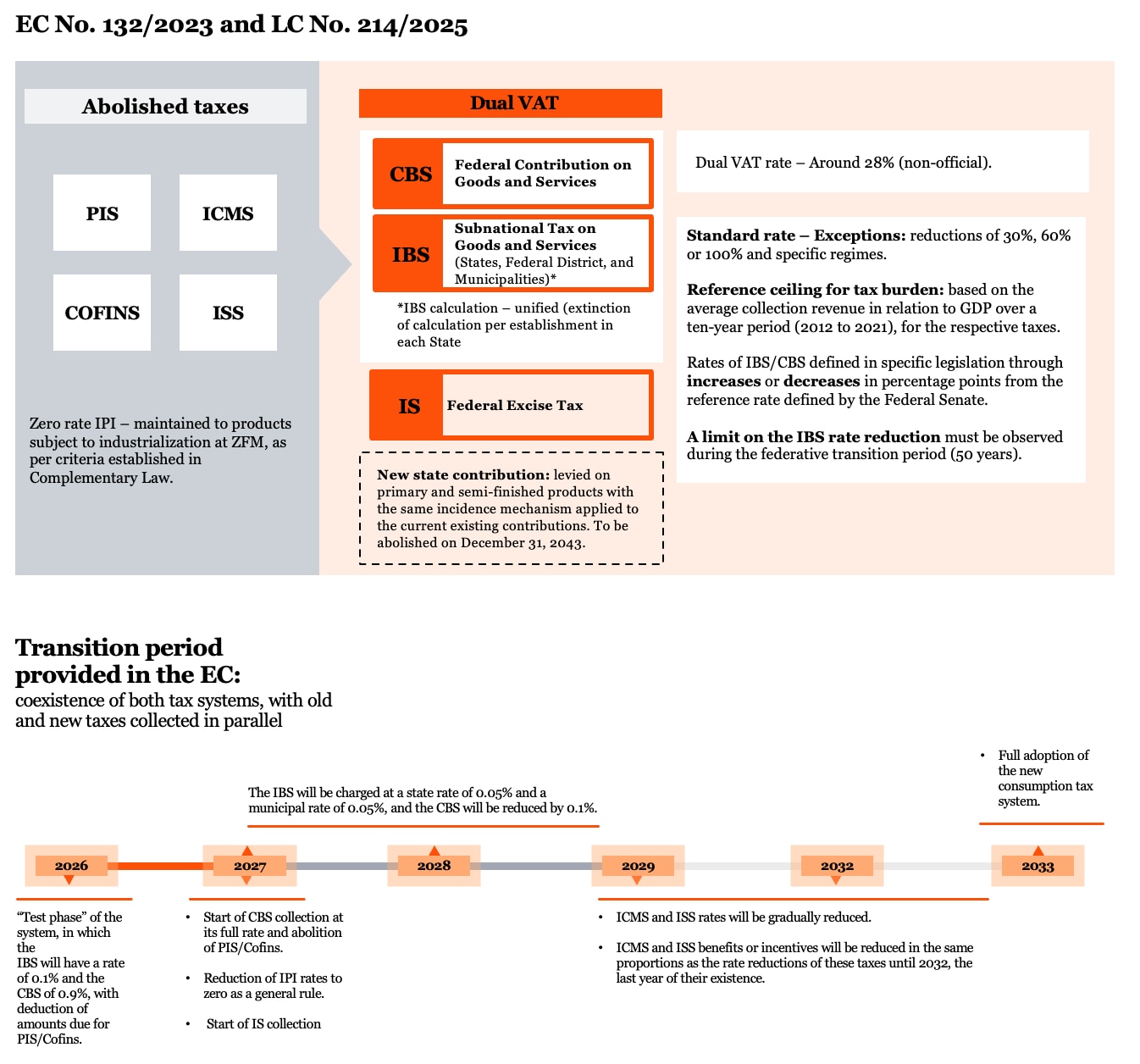

The VAT Reform proposes to replace four taxes currently levied on consumption — PIS, Cofins, ICMS, and ISS — and to reduce the scope of IPI. In their place, the Contribution on Goods and Services (CBS), the Tax on Goods and Services (IBS), and the Selective Tax (IS) will be introduced. This reform aims to simplify and rationalize the tax system, contributing to a more competitive and efficient business environment.

Constitutional Amendment (EC) No. 132 significantly simplifies and rationalizes consumption taxation, which is crucial for enhancing any business environment. It does so by:

- Unifying two federal taxes levied on consumption (PIS/Cofins), one state tax (ICMS), and one municipal tax (ISS) into a single type of Value Added Tax (VAT), although divided into two jurisdictions, one Federal and the other Subnational (dual VAT).

- Enhancing transparency by implementing “external’ taxation,” which is visible to taxpayers and consumers. At the destination, this approach helps eliminate the so-called “fiscal war” among states. It supports the development of business ventures with an economic and financial rationale that is not primarily dependent on tax benefits.

- Addressing the broad non-cumulativity essential to eliminating tax residues harmful to the competitiveness of Brazilian companies.

- Exempting exports and investments from taxes by providing a safer mechanism for reimbursing accumulated credits from new taxes.

- Contributing to a decrease in the nation’s tax litigation and potentially reducing the high costs of compliance over the medium to long term, especially if it is supported by tangible measures that effectively address taxpayers’ significant and justified demands.

- Creating a fund aimed at compensating companies that benefit from fiscal incentives related to ICMS, respecting the return on investments legitimately planned based on such incentives.

It should also be emphasized that to fully realize the goals of simplification and rationalization, the set of complementary laws, statutes, and sub-legal regulations developed to implement EC No. 132 must preserve the underlying principles of VAT taxation as outlined in the Constitutional Text.

EC No. 132/2023, which establishes the VAT Reform, set a deadline of 180 days for the Executive Branch to submit legislative projects to the National Congress to regulate its terms. Complying with this deadline, the Executive Branch has filed two Complementary Bills of Law (PLPs) in the Chamber of Deputies:

- PLP No. 68/2024, converted into Complementary Law (LC) No. 214/2025: defines the new taxes (IBS, CBS, and IS) and the mechanisms for credit and reimbursement of IBS and CBS, governs the transition period, and establishes special regimes and all other main topics of the VAT Reform.

- PLP No.108/2024: Focused on regulating the IBS Management Committee, addresses the competencies, guidelines, administrative processes, and the tax litigation of the new tax. The referred PLP has already been approved at the Deputies Chamber and now waits for appreciation by the Federal Senate.

The regulation of the Reform does not stop there. It still depends on a set of ordinary laws and sub-legal regulations.

In light of this scenario, we advise companies across diverse economic sectors to protect their legitimate interests in the ongoing legislative debate actively. They should strive to align these interests with the essential simplification and rationalization of the Brazilian consumption tax system, aiming to enhance the country’s business environment.

Introduced by LC No. 214/2025, the split payment mechanism for IBS and CBS will be implemented during the financial settlement of transactions. This process involves the segregation and remittance of IBS and CBS amounts by digital payment service providers.

As announced by the Extraordinary Secretariat of Tax Reform, the intention is that, with the exclusive adoption of electronic fiscal documentation for the new taxes, the purchaser’s utilization of the corresponding credit will be conditioned on the effective tax payment at the previous stage. Also, the method of assessment and payment will be carried out by plit payment, amongst other methods.

Our approach

- Business impact: what should be the focus of companies at this time?

- How to extract value and create opportunities?

- How can we help?

Business impact: what should be the focus of companies at this time?

The impact of the new tax system will differ across business segments and vary depending on the position of each link in a company’s production chain. This requires strategic and operational adjustments that consider a range of factors, including:

- Gradual loss of fiscal incentives versus logistical and operational efficiency gains resulting from the relocation of operations.

- Prospects for changes in sales prices, considering demand elasticity, or changes in supply costs, considering impacts on margins of suppliers or customers in B2B chains.

- Reduction of investment (working capital) in multilocalized inventories.

- Reduction of costs and flows of cargo transport.

- Gains in synergy resulting from integrating operations and reducing legal entities within the same economic group.

How to extract value and create opportunities?

It is necessary to anticipate the economic impacts, both macro and micro, by segment and market of operation. This involves evaluating the effects of changes on the competitive landscape and the entry of new players, considering the influence of new effective tax rates on consumer demand, among other factors that could significantly affect both the volume and the return on investments.

The more rapid, strategic, and comprehensive these analyses and decisions are, the greater the non-tax efficiency gains that can be achieved, and the lesser the impacts on the valuation (or unavailability) of real estate and labor in potential relocation scenarios, for example.

The VAT reform should be considered a disruptive factor in an organization’s strategic context. Given its complexity, breadth, and importance, it should continue to be a priority on the agendas of Boards and C-level executives in the forthcoming years.

How can we help?

The VAT Reform should be viewed as a significant opportunity to establish a competitive advantage in domestic and international environments. This advantage is expected to emerge through a comprehensive risk management strategy that transforms risks into opportunities, bolstered by advanced technology and cohesive predictive data analysis, thus acting as a potent value driver for your business.

PwC Brasil advises initiating comprehensive impact analyses immediately to determine how to strategically extract value from the reform. This early preparation is crucial, enabling companies to swiftly adapt to new requirements, mitigate risks, and capitalize on emerging opportunities. Such planning will better equip organizations to navigate the challenges and maximize the advantages of this new tax landscape.

How can we contribute to your transformation journey?

Our approach to the impacts of the VAT Reform is holistic. We assess different scenarios and their economic-tax and extra-fiscal effects on businesses. This analysis can be implemented immediately in its entirety or executed in phased stages.

- Current operation assessment (“AS IS”): Analysis of operational insights, including the tax logistics network (dispersion of suppliers and clients, factories, and distribution centers) and mapping of the current tax model’s taxes and capabilities. This involves thoroughly examining and discussing tax aspects related to the future model shaped by the VAT Reform.

- Scenario review (“TO BE”): Modeling the future scenario considering the impact of the Reform, using cutting-edge technological solutions and detailed analyses. Review the tax scenario and discuss the results with the company, presenting alternatives.

- Scenario consolidation (“AS IS x TO BE”): Development of a comparative matrix of the “AS IS” and “TO BE” scenarios mapped to construct a change case, presenting the pros and cons related to the scenario studies.

- Design and transformation: Planning the budget to include systems, personnel, and external consultants, among other components, while accurately quantifying the financial impact of the VAT Reform. This involves establishing governance structures and a comprehensive communication plan, setting clear priorities and milestones, and defining key performance indicators (KPIs) to monitor adaptation effectively.

- Implementation: Identifying areas for optimization and process improvement, from restructuring the operational model to adapting systems according to the chosen scenario.

- Operation / Scale ROI: Monitoring the new KPIs, seeking continuous process improvement, and maintaining a strategic partnership with the business to ensure the sustainability of operations in the new tax scenario. Execution of the communication plan and connected and efficient compliance.

PwC Brasil is committed to supporting its clients on their journey to adapt to the new reality, turning challenges into opportunities for sustainable value.

Our technological solution, the Tax Reform Explorer, enables the simulation of the reform’s fiscal impacts and the creation of an efficient and comprehensive strategic plan.

Tax Reform Explorer: optimizing your fiscal journey in the VAT Reform

The Tax Reform Explorer is an innovative technological solution designed by PwC to analyze, measure, and simulate the fiscal impacts of the reform. It represents a key component of our comprehensive risk management approach, developed through a dynamic co-creation process with company managers and grounded in business operations’ actual data and reality.

Main features

Comparison/Mapping of “As Is” and “To Be” scenarios: The Tax Reform Explorer goes beyond simply calculating the primary and general impacts of the VAT Reform on business operations. It categorizes concrete fiscal data from these operations comprehensively and rationally. From this foundation, it simulates a range of scenarios, from basic comparisons between the current and projected tax burdens through the complex transition between two consumption tax systems to exploring the outcomes of strategic decisions and their potential future impacts on the business.

Flexibility and adaptation:

- The solution is adaptable, tailored to fit a variety of circumstances, and recognizes the Reform as a disruptive factor in an ever-evolving business landscape, whether due to ongoing changes in regulations or as a result of personalized, finely crafted interactions with the reality of the company through co-created scenarios and analysis with its managers.

Our holistic approach to risk management, which converts risks into opportunities, is bolstered by integrated technology and predictive data analysis, including our exclusive generative AI, ChatPwC*.

*Usage is subject to specific data availability policies/rules.

Tax Intelligence: from complexity to execution

Tax Intelligence is a PwC Brasil newsletter covering the latest legislative and judicial developments. It contains in-depth analyses with a pragmatic approach to topics impacting the tax, financial, and economic environments.

Throughout the approval process of EC No. 132 and after it, we have produced various Tax Intelligence issues designed to track the latest updates and analyses on the VAT Reform and related content, providing knowledge and insights for our clients in the form of Takeaways.

- Publication of Complementary Law Nº. 214/2025

- Approval of PLP No. 68/2024

- PLP No. 108/2024: Establishment of the Management Committee for the IBS

- Brazil’s VAT Reform – Holistic approach to risk management to achieve value

- Brazil’s VAT Reform – Constitutional Amendment enacted by the Brazilian Congress

Regional Connected Tax Conference

The Regional Connected Tax Conference is an event hosted by PwC Brazil that annually brings together local and international experts to explore key topics such as Transfer Pricing, Pillar 2, and VAT/Tax Reform on consumption. The conference offers a series of discussions on how businesses can prepare for the challenges arising from major changes in both the local and global tax landscapes.You can find out more about the 2025 edition in the section beside.

Our content on the VAT Reform

Contact us